We Recently Got Married or Had Kids…What Kind of Basic Planning Should We Be Doing?

/Over the next few days, we are going to examine a few topics that are often of concern to many people in their twenties. This is the first edition in a series of blogs that will examine hot-button issues that over the years I have seen consistently be of concern to certain age groups. I will also try to give some practical advice on how to address them.

Things are going great…you both graduated from college a couple of years ago, you got married, you both got super jobs making good money, you have a baby on the way. You’re drifting off to sleep in each other’s arms…when all of a sudden, your eyes pop open and you panic and realize, “I’m about to become an adult now!!!” I know that exact feeling. If you haven’t had it yet, it’s coming, and it’s scary.

I’m often asked by young parents what they should be doing from a financial planning standpoint. That’s a tough question, because everyone is different, but I’ll start with a few generalities:

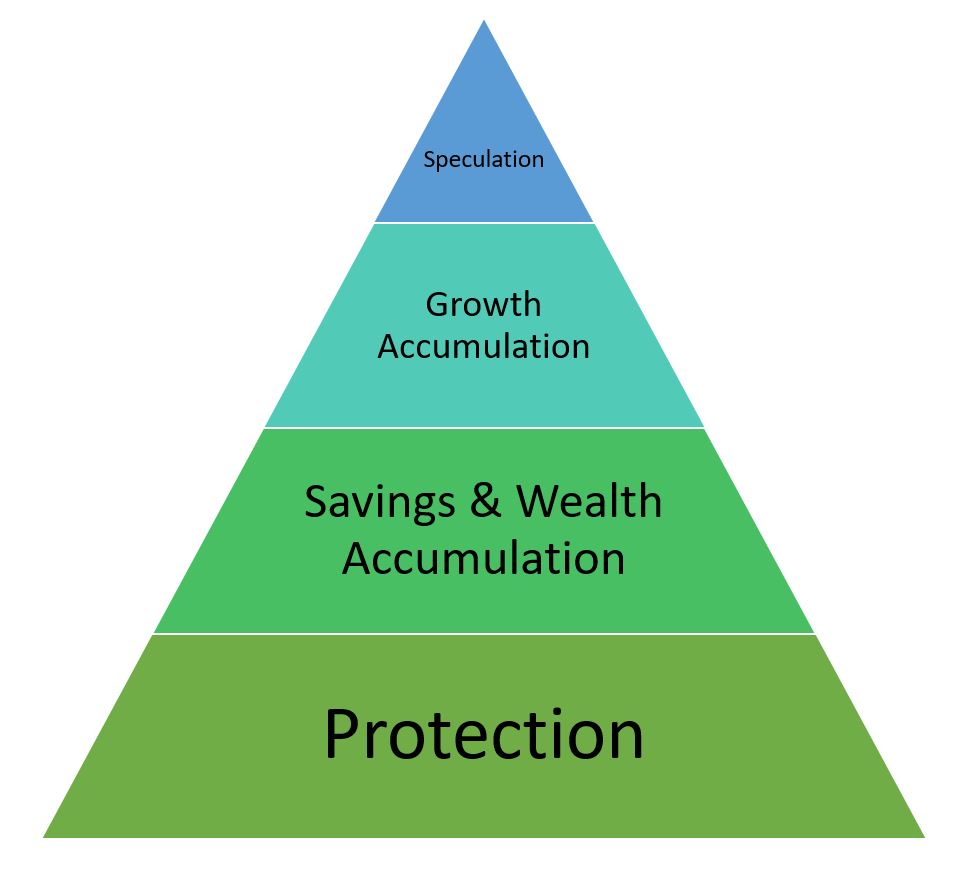

Think about planning kind of like the old food pyramid. You have the essentials at the bottom, and then you build on those essentials with other elements of the plan as you make your way to the top.

Protection: Think about what would happen if the breadwinner(s) were too sick or hurt to work, or died and that income was gone. What impact would that have on the family? Think not only in terms of the dollars missing, but also the help with kids, and doing chores around the house. Also, don’t discount the value of a stay-at-home spouse. Check out this video. This means taking a look at life and disability coverage that you may already have, and then seeing if you need more to keep your family in the same standard of living.

College Funding: According to US News and World Report, the average cost of a four-year public college education in 2030 will be $205,000. Tuition in America is rising by 6.5%, far outpacing inflation. Putting money into a 529 college savings plan is a great way to set money aside (with limits) that can grow tax-deferred for college expenses.

Retirement Savings: If there is a match available to you, make sure that you are at least getting that match. Remember, your employer is effectively giving you free money, but you must put in a certain amount for them to give you the full match. Know what those amounts are!

Estate Planning: Don’t forget the kids! If you don’t have a will, powers of attorney, and living wills, stop what you’re doing, and get in touch with an estate planning attorney to get them done. Here’s why: if you die and haven’t named a guardian for your children, the courts will decide who that guardian will be (and think about successor guardians if parents or other potential guardians are getting older). Also, you have the power to name a trustee for the funds you leave behind, and how the funds will be distributed to your beneficiaries.

Of course, this piece touches on a few of the main concerns I often see. If you are interested in discussing your particular situation, feel free to contact me.

Monte Miller (865) 776-5577monte@crestpointwealth.com